Perth Mint: history, products and 2020 report

Introduction

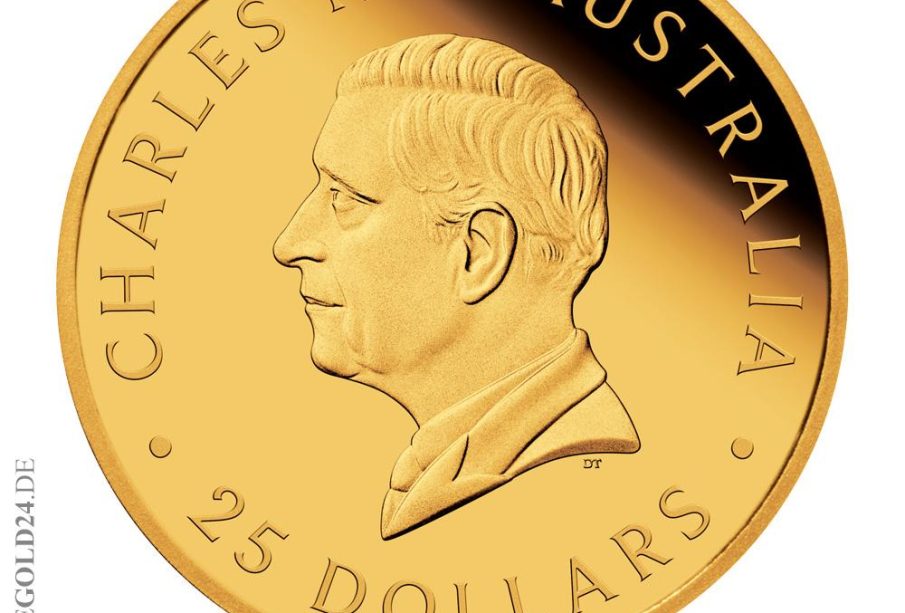

The Perth Mint is a significant institution in Australia’s bullion and numismatic sectors. Established in 1899, it has served as a central facility for refining gold and producing legal-tender coinage. Its activities are relevant to investors, collectors and policymakers because they combine historical minting responsibilities with modern commercial operations in gold, silver and platinum.

Main body

History and role

The Perth Mint was established on 20 June 1899, two years before Australia’s Federation in 1901. It was the last of three Australian colonial branches of the United Kingdom’s Royal Mint, following the Sydney Mint and the Melbourne Mint. The original purpose was to refine gold from the gold rushes and mint gold sovereigns and half‑sovereigns for the British Empire.

Authority and operations

Under a unique agreement with the Commonwealth of Australia’s Department of the Treasury, the Perth Mint’s operator was empowered to mint and market Australian legal tender coinage in gold, silver and platinum to investors and collectors worldwide. That commercial role extends beyond coinage into sales of bullion and luxury items.

Products and distribution

The Perth Mint manufactures and sells a range of products: gold, silver and platinum collector coins; gold and silver bullion bars and coins; and luxury jewellery. These offerings target both the investment market and collectors seeking certified legal‑tender pieces.

Third‑party distribution example

Retailers and distributors sometimes highlight handling guarantees. For example, APMEX offers MintDirect® from the Perth Mint, providing coins directly from sealed boxes and MintDirect® Tubes sealed in tamper‑proof packaging to assure buyers of untouched condition.

2020 Financial Review report

On 20 October 2020, the Financial Review reported that the Perth Mint allowed clients of a tax‑haven bank under investigation for links to global organised crime syndicates to purchase more than $100 million of gold without conducting the identity checks required to prevent money laundering. The report raised concerns about compliance with anti‑money laundering procedures in large transactions.

Conclusion

The Perth Mint remains an institution with deep historical roots and a wide product range for investors and collectors. Recent scrutiny from media reports about compliance practices highlights ongoing challenges in balancing global commercial activity with regulatory obligations. For readers, the mint’s history, product assurances like sealed MintDirect offerings, and compliance record are important considerations when assessing trust and risk in bullion purchases.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.