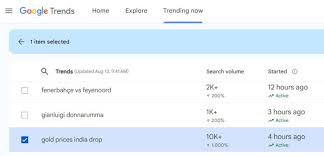

Gold price in India — drivers, trends and outlook

Introduction: Why the gold price in India matters

The gold price in India is closely watched by consumers, jewellers, investors and policymakers because India is one of the world’s largest markets for physical gold. Movements in local gold prices affect household savings, wedding and festival spending, import bills and the balance of payments. Understanding the forces behind price changes helps readers make better decisions about buying, selling or holding gold.

Main body: What drives gold prices and what to watch

Global spot price and domestic transmission

Global spot gold prices, typically quoted in US dollars per troy ounce, form the base for local prices. Changes in the global market — driven by monetary policy expectations, real interest rates, geopolitical risk and investor flows into gold ETFs — pass through to Indian prices after accounting for import costs and currency movements.

Exchange rate and import duties

The rupee–dollar exchange rate is a direct channel: a weaker rupee raises the local rupee price of dollar-priced gold. Import duties, custom handling charges and local taxes also add to the final retail price consumers pay, and any policy changes in these areas can shift demand patterns.

Domestic demand patterns

Demand in India is seasonal and culturally driven. Weddings and festival seasons typically boost retail purchases of jewellery. Conversely, in times of economic stress, households may sell jewellery to meet liquidity needs. Central bank purchases and the activity of local dealers and micro-investors also influence supply and demand dynamics.

Interest rates and inflation

Real interest rates and inflation expectations affect gold’s appeal as an inflation hedge and alternative asset. Lower real yields tend to support higher gold demand, while rising real yields can reduce investor interest in non-yielding assets like gold.

Conclusion: Implications and near-term outlook

For readers, the key takeaway is that the gold price in India reflects a mix of global market movements, currency swings, policy and local demand cycles. Short-term price swings are common; those considering purchases or sales should weigh timing against long-term goals, seasonal needs and broader economic indicators such as the rupee trend and interest-rate outlook. Monitoring these drivers can help consumers and investors make more informed choices about gold holdings.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.