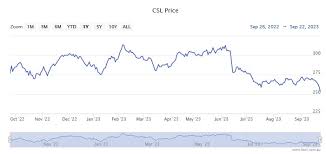

CSL share price: drivers, trends and investor outlook

Introduction — why CSL share price matters

CSL is one of Australia’s largest listed companies and a major global player in biopharmaceuticals. Movements in the CSL share price are closely watched by domestic and international investors because they reflect sentiment toward the broader healthcare and biotechnology sectors, influence portfolio allocations on the ASX and signal investor confidence in medical innovation. Understanding the drivers behind CSL’s stock helps readers assess risk, dividend prospects and exposure to industry trends such as demand for plasma-derived therapies and vaccines.

Main body — factors influencing CSL share price

Business fundamentals

CSL’s core activities include plasma-derived therapies and influenza vaccine production (through Seqirus). Revenue and profit trends hinge on plasma collection volumes, pricing for specialty therapies, successful launches and the lifecycle management of existing products. Stable demand for critical therapies can support earnings, while disruptions in supply chains or collection networks can create volatility.

Regulatory and clinical developments

Regulatory approvals, clinical trial outcomes and safety reporting have direct implications for valuation. Positive regulatory decisions or expansion of indications typically support share-price gains; conversely, setbacks or product recalls can lead to rapid reassessment by the market.

Market and macro drivers

Investor sentiment toward growth and defensive stocks, interest rates, currency movements (AUD strength/weakness) and broader equity market trends all affect CSL’s share price. As a global exporter, CSL is sensitive to foreign exchange and global healthcare spending patterns. Analyst commentary and institutional buying or selling also contribute to short-term price action.

Corporate actions and returns

Dividend policy, capital allocation, and acquisitions or partnerships are additional levers. Sustained dividends or clear reinvestment into high-return R&D projects can support longer-term investor confidence.

Conclusion — outlook and implications for readers

Investors should view CSL share price movements in the context of company fundamentals, product pipelines and external factors such as regulation and macroeconomic conditions. Short-term volatility is possible, while long-term performance will depend on continued demand for plasma therapies, successful innovation and operational resilience. For individual investors, monitoring quarterly results, regulatory updates and plasma supply trends will provide the clearest signals for adjusting exposure to CSL. Financial advice tailored to personal circumstances is recommended before making investment decisions.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.