London house prices crash: sharp falls and cautious forecasts

Introduction

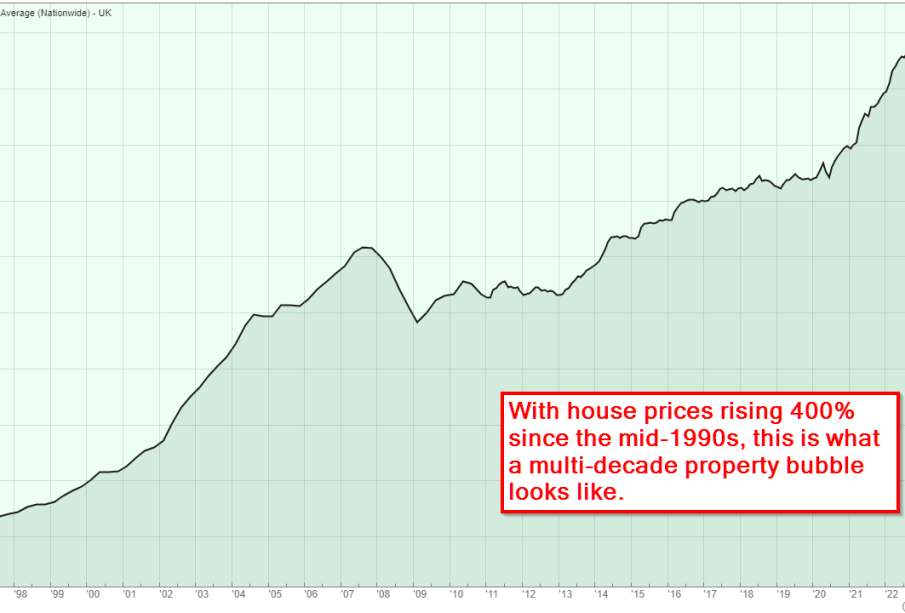

The topic of a london house prices crash matters for homeowners, buyers and the wider economy. London has long been a linchpin of the UK property market and shifts there influence lending, investment and household wealth. Recent data pointing to steep price falls in parts of the capital has renewed debate about affordability, market stability and when a recovery might begin.

Main details

Prices and regions

Reports indicate that prices in parts of London are in freefall. In some neighbourhoods owners have been forced to cut their losses and sell for up to 50 per cent below what they originally paid. Such large discounts are concentrated in specific pockets rather than being uniform across the whole city, but they underline the severity of adjustments being seen in weaker sub‑markets.

Monthly and annual moves

Official measures and market commentary show recent sharp short‑term declines. Inner London house prices fell 4.6 per cent year on year in November, following a 4.3 per cent tumble in October. Those consecutive falls represent some of the largest recent declines recorded in the capital and reflect a combination of reduced buyer demand and broader economic and political uncertainty.

Drivers and market context

Analysts point to a mix of factors including speculation around the Budget, higher mortgage costs and changing locational demand after the pandemic. Budget speculation in particular has been linked to the inner London slump, as buyers reassess affordability and tax or policy implications. The impact is uneven: prime central areas, commuter corridors and outer suburbs have shown different dynamics.

Outlook

Market forecasts are cautious. A study by Rightmove predicts that London house prices will rise by just over 1 per cent next year, compared with an average 2–3 per cent increase across the wider market. That projections suggests a modest recovery rather than a swift rebound, leaving many sellers and some buyers in a prolonged period of adjustment.

Conclusion

The london house prices crash in parts of the capital highlights sharp localised corrections amid broader market fragility. While headline annual falls have been significant, forecasters expect only a modest rise next year. For readers, this means continued caution: sellers may need realistic pricing, and buyers should weigh long‑term fundamentals against short‑term volatility.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.