Understanding the s and p 500: What Investors Need to Know

Introduction

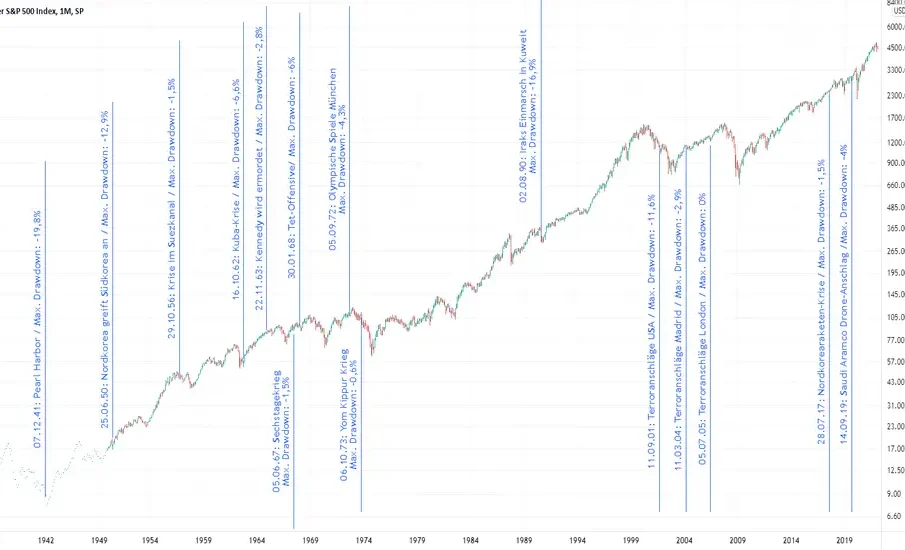

The s and p 500 is one of the most important stock‑market benchmarks globally. For investors, policymakers and market watchers, the index provides a concise picture of large‑cap U.S. equity performance and is widely used as a performance benchmark for portfolios and funds. Its relevance extends beyond the United States: international investors and institutions reference the s and p 500 when assessing global market trends and risk exposure.

Main body

What the s and p 500 is

The s and p 500 (Standard & Poor’s 500) is a stock market index that tracks the stock performance of 500 leading companies listed on U.S. stock exchanges. It is designed to represent large‑capitalisation U.S. equities and is commonly described as the best single gauge of large‑cap U.S. stocks. The index tracks share prices of 500 of the largest publicly traded companies in the United States, making it a broad measure of the large‑cap segment.

Coverage and significance

S&P Dow Jones Indices and S&P Global note that the s and p 500 covers approximately 80% of the investable U.S. equity market by market capitalisation, which contributes to its widespread use as a benchmark. Because it includes many of the largest and most widely held companies, movements in the index are often used to summarise overall investor sentiment about the U.S. economy and corporate profitability.

Related indices and context

The s and p 500 sits within a family of S&P indices that cover different market segments. Other indices referenced alongside it include the S&P 100, S&P 400, S&P 600 and broader compilations such as the S&P 1000 and S&P 3000. Financial commentators and institutions often use these alternatives to analyse mid‑ and small‑cap performance or sectoral shifts relative to the large‑cap benchmark provided by the s and p 500.

Conclusion

As a widely regarded gauge of large‑cap U.S. equities, the s and p 500 remains central to market analysis and investment decision‑making. Its breadth — covering about 80% of U.S. market capitalisation — and its inclusion of 500 leading companies give it strong representative power. For readers and investors, tracking the s and p 500 offers a practical way to monitor major shifts in U.S. equity markets and to benchmark portfolio performance. Given its institutional role, the index is likely to remain a primary reference point for global equity assessment.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.