Understanding the ANZ Share Price: Recent Trends and Insights

Introduction

The ANZ (Australia and New Zealand Banking Group) share price has been a focal point for investors, analysts, and the general public due to its implications for the financial market and overall economic health in Australia. Share prices reflect not just a company’s current position but also forecasts of its future performance, making them critical for investment decisions.

Current Trends

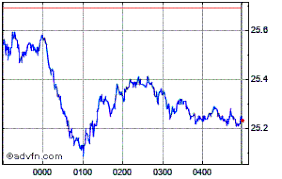

As of October 2023, the ANZ share price has shown resilience amid a volatile economic landscape characterized by rising interest rates and inflationary pressures. The shares recently traded at approximately AUD 25.30, a notable increase of 3% over the past week, which comes in contrast to broader market trends where many financial stocks have struggled.

Key factors influencing the price include ANZ’s strong quarterly earnings report, which highlighted a 10% year-on-year growth in net profit. Additionally, investor confidence has been buoyed by the bank’s robust performance in its home loan and institutional banking segments, demonstrating its capacity to navigate the challenging economic environment. Market analysts are projecting a positive outlook for the upcoming fiscal quarters, especially as interest margin spreads are expected to widen.

Market Reaction

The recent surge in the ANZ share price has been met with optimism from analysts. Many are revising their price targets upwards, citing strong fundamentals and effective cost management strategies. Furthermore, the bank’s ongoing digital transformation initiatives are seen as future growth drivers. However, experts also caution that potential headwinds, such as economic slowdowns and regulatory challenges, could impact future performance.

Conclusion

In conclusion, the ANZ share price represents more than just the bank’s valuation; it reflects the wider economic climate and investor sentiment. As the bank continues to adapt to changes and leverage growth opportunities, investors may find potential in its stock. However, it remains crucial for potential investors to stay informed on market dynamics and economic variables that could influence ANZ’s performance moving forward. As of now, the trends are promising, but foresight and careful observation will be key to navigating the investment landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.