Understanding Current Trends in Ethereum Price

Introduction

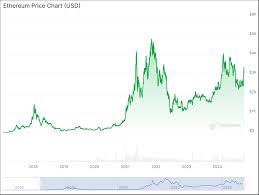

Ethereum, the second-largest cryptocurrency by market capitalisation, has seen significant fluctuations in its price over the past year. As one of the foundational platforms for decentralised applications (dApps) and smart contracts, understanding the forces driving Ethereum’s price is essential for investors and enthusiasts alike. Recent events in the crypto world, regulatory changes, and technological advancements are shaping the future of this digital asset.

Recent Price Movements

As of October 2023, the price of Ethereum (ETH) is experiencing notable volatility. On October 10, it peaked at AUD 4,300, driven by optimism around new upgrades and increased institutional investment. However, following a broader market correction in light of regulatory scrutiny on cryptocurrencies, the price dipped by 15% over the following two weeks. Analysts attribute this volatility to a mix of macroeconomic factors, such as inflation concerns, as well as specific developments within the Ethereum ecosystem, including the anticipated launch of Ethereum 2.0.

Market Influences

Several factors continue to impact Ethereum’s price trajectory. Firstly, the growing interest from institutional investors, evidenced by large purchases from hedge funds, has provided a strong underpinning for ETH’s value. Furthermore, the shift towards proof-of-stake consensus in Ethereum 2.0 has generated excitement, as it promises to reduce energy consumption and improve transaction speeds. However, concerns over scalability remain, with developers pushing for further upgrades to the network.

Conclusion and Future Outlook

The Ethereum price remains a focal point in the cryptocurrency market, influencing trends across various digital assets. Experts suggest that while short-term price movements may be erratic, the long-term outlook for Ethereum remains bullish, particularly as adoption of blockchain technology grows across industries. Investors are advised to stay informed on macroeconomic conditions and potential regulatory developments, which are likely to affect price stability. Understanding these dynamics could aid in making more informed investment decisions in the fast-evolving crypto landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.