Understanding Bitcoin USD: Trends and Insights

Introduction

Bitcoin, the pioneering cryptocurrency, has gained remarkable prominence since its inception in 2009. Its value against the US dollar (USD) is particularly significant, as it serves as a benchmark for the entire cryptocurrency market. Recent fluctuations in the Bitcoin USD price have drawn the attention of both investors and analysts, highlighting its relevance in today’s financial landscape.

Current Market Trends

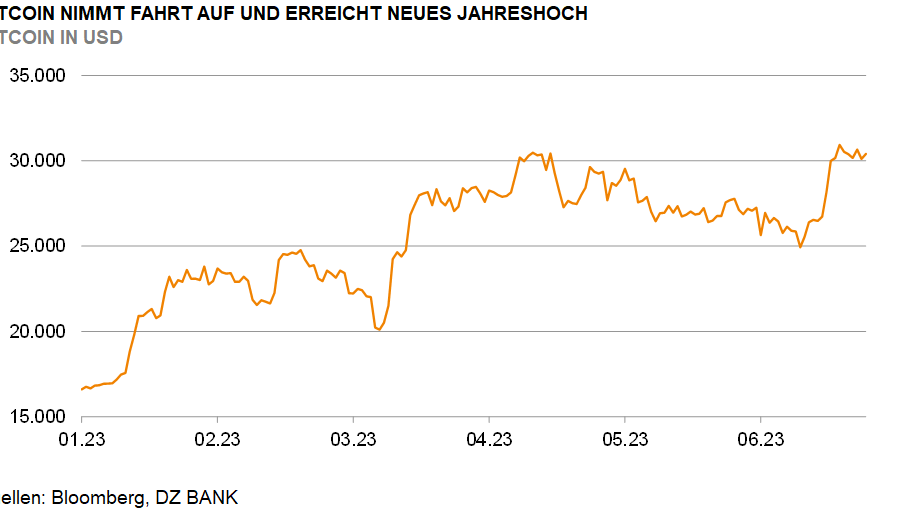

As of October 2023, Bitcoin has demonstrated volatility, with prices hovering around $30,000 USD. This recent level follows a period of significant fluctuations, where it surged to over $60,000 earlier in 2021 before plummeting in subsequent years. The reasons behind such volatility often include regulatory news, technological advancements, and changes in investor sentiment.

In recent weeks, Bitcoin’s price has been influenced by various factors including macroeconomic indicators, such as inflation rates and interest rates in the US, which directly affect investor sentiment towards risk-on assets like cryptocurrencies. Notably, the ongoing discussion around Bitcoin Exchange-Traded Funds (ETFs) also plays a crucial role in shaping market expectations.

Regulatory Developments

Regulation remains a critical aspect influencing Bitcoin’s USD value. In Australia, regulatory bodies are examining the implications of cryptocurrency in the broader financial framework. This includes measures aimed at protecting consumers while promoting innovation within the sector. Enhanced regulatory clarity may influence Bitcoin’s adoption and, consequently, its price.

Future Outlook

Analysts and traders remain divided on Bitcoin’s future trajectory against the USD. While some predict a bullish long-term outlook, citing increasing institutional adoption and technological integration, others express caution due to potential regulatory crackdowns and market corrections. Many experts suggest that if Bitcoin can maintain its current price above $30,000, it may stabilize, offering a more predictable trading environment for investors.

Conclusion

The relationship between Bitcoin and the USD continues to evolve, reflecting broader economic trends and societal attitudes towards digital currencies. For readers and potential investors, understanding these trends is essential for navigating the cryptocurrency market. As developments unfold, staying informed will be key in making informed financial decisions in this dynamic landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.