Current Trends and Effects of Inflation in Australia

Introduction

Inflation is a crucial economic indicator that affects almost every aspect of life in Australia. It influences prices, purchasing power, and the overall economic stability of the nation. As inflation levels continue to fluctuate, understanding its implications is vital for consumers, businesses, and policymakers alike.

Current Inflation Rates

As of October 2023, Australia’s inflation rate stands at approximately 5.3%, according to the Australian Bureau of Statistics (ABS). This figure, while lower than the peak experienced in 2022, still represents significant cost pressures on households. The Reserve Bank of Australia (RBA) has indicated that inflation rates remain above its target band of 2-3%, prompting ongoing discussions about monetary policy adjustments.

Factors Influencing Inflation

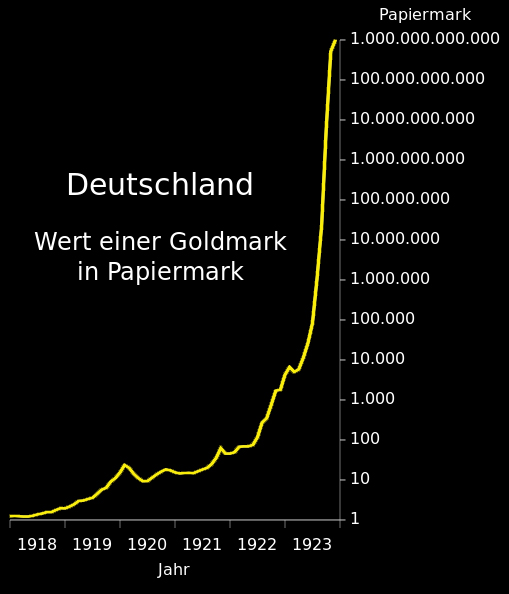

Several key factors contribute to the current inflationary trend in Australia. Rising energy prices have been a significant driver, influenced by global supply chain disruptions and ongoing geopolitical tensions. Additionally, labour shortages in several sectors have led to wage increases, further contributing to inflationary pressures.

Additionally, the aftermath of the pandemic continues to impact economic activity. Demand for goods and services has rebounded, putting additional strain on supply chains. These cumulative effects highlight the interconnectedness of global economic conditions and domestic inflation.

Impact on Households and Businesses

The effects of inflation are particularly pronounced for everyday consumers. Households are facing increased costs for essentials such as food, housing, and fuel. This decrease in purchasing power is forcing families to re-evaluate their budgets and spending habits. A recent survey revealed that over 60% of Australians are concerned about rising costs impacting their ability to meet everyday expenses.

Businesses too are grappling with the challenges of inflation. Many are forced to pass on increased costs to consumers, which can lead to a decrease in sales and consumer spending. Those in industries reliant on imported goods are facing additional hurdles as exchange rates fluctuate and import costs rise.

Conclusion

The ongoing issue of inflation in Australia presents a complex challenge with wide-ranging implications for economic stability and consumer welfare. As Australia navigates these inflationary pressures, the role of monetary policy will be critical in balancing growth and price stability. Economists predict that while inflation may gradually decline in 2024, households and businesses will need to adapt to a new economic landscape. Understanding these challenges and actively planning for them will be crucial for Australians moving forward.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.