The Rise of Afterpay in Australia: A Financial Revolution

Introduction

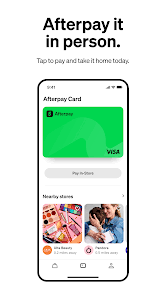

Afterpay, a leading buy now, pay later (BNPL) service in Australia, has changed how consumers shop and pay. Launched in 2014, it allows users to make purchases immediately and pay for them in four equal instalments over time, interest-free. The relevance of Afterpay in the current economic climate cannot be overstated, as consumers seek more flexible payment options amid rising costs of living.

The Growth of Afterpay

Since its inception, Afterpay has experienced exponential growth. As of 2023, it boasts over 7 million active customers in Australia alone, and is accepted at over 100,000 retailers internationally, including major brands such as Adidas, Sephora, and Amazon. The COVID-19 pandemic accelerated its popularity, as more people moved to online shopping. An estimated 30% of Australians aged 18-29 have used Afterpay, showcasing its appeal to younger consumers who value instant access to products and flexible payment schemes.

Recent Developments

Afterpay was acquired by Square, Inc. in 2021 for $29 billion, signalling confidence in the BNPL sector. This merger allows Afterpay to expand its offerings while tapping into Square’s payment processing services. Recently, Afterpay has faced increased regulatory scrutiny, with the Australian government considering new rules to ensure consumer protection as the BNPL market grows. This includes compulsory credit checks and transparency in fees, aimed at preventing consumers from falling into debt traps.

Benefits and Challenges

For consumers, Afterpay provides financial flexibility, allowing for easier budgeting without incurring interest or debt if payments are made on time. However, critics argue that it may encourage overspending and poor financial habits. A recent survey indicated that nearly 40% of Afterpay users believe it influences them to spend more than they otherwise would. Thus, while Afterpay has democratized access to credit, users must remain vigilant about their financial health.

Conclusion

As Afterpay continues to evolve amid changing regulations and market conditions, its impact on Australian consumer culture is undeniable. With forecasts indicating steady growth in the BNPL sector, both consumers and investors will be watching closely. The ongoing challenge will be to balance the benefits of flexible payments with prudent financial management. Ultimately, Afterpay has ushered in a new era of spending, reflecting broader shifts in consumer behaviour and retail economics in Australia.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.