Understanding the Latest RBA Interest Rates

The Importance of RBA Interest Rates

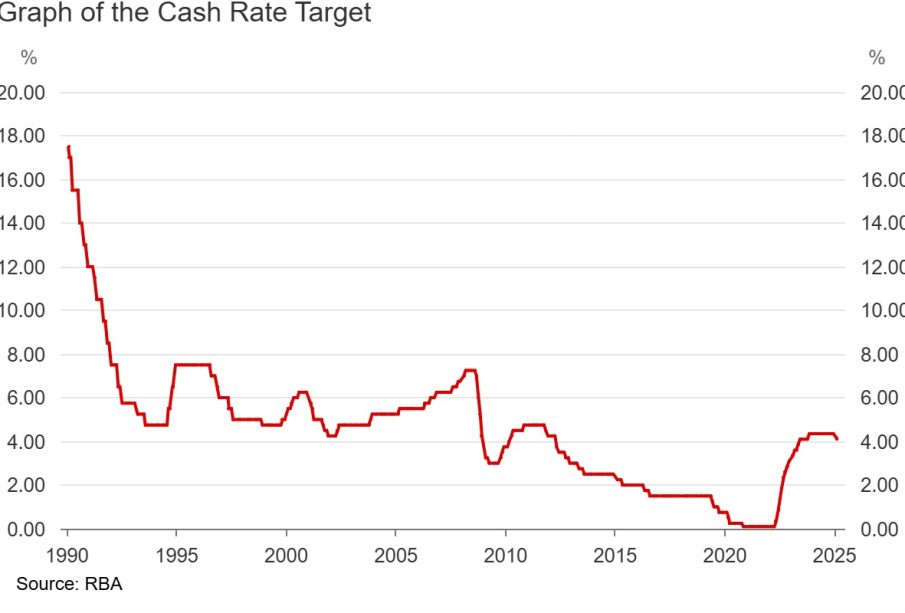

The Reserve Bank of Australia (RBA) plays a crucial role in shaping Australia’s economic landscape primarily through its monetary policy decisions, particularly regarding interest rates. The RBA sets the cash rate, which influences borrowing costs for consumers and businesses, ultimately impacting spending, saving, and overall economic growth. In light of recent global events and economic changes, understanding the latest adjustments to the RBA’s interest rates is more important than ever for both consumers and financial markets.

Recent Developments

As of November 2023, the RBA’s cash rate sits at 4.10%. In a recent meeting, the RBA held the rate steady, signalling a cautious approach amid ongoing inflationary pressures. After a series of increases throughout 2022 and early 2023 aimed at combating rising consumer prices, the central bank has indicated that while inflation appears to be stabilising, it remains above the bank’s target range of 2% to 3%.

The decision to maintain the current interest rate has been attributed to concerns regarding economic growth. The Australian economy showed signs of slowing in recent quarters, affected by higher borrowing costs, elevated living expenses, and shifting global economic conditions. Notably, analysts are closely watching consumer confidence indicators, which have shown volatility in recent months, reflecting how interest rates impact household spending.

The Impact on Consumers and Businesses

For everyday Australians, the stability of the cash rate means that mortgage repayments will remain constant for the time being, providing a degree of relief for those on fixed-rate loans. However, for those with variable-rate loans, the RBA’s past rate hikes have already increased costs significantly, making it essential for consumers to reassess their financial situations.

Businesses, on the other hand, are experiencing mixed effects. While some sectors, particularly housing and construction, have felt the pinch from higher rates, others, like the export sector, may benefit from a stable exchange rate that often accompanies steady interest rate policies.

Conclusion and Future Outlook

The RBA’s decision regarding interest rates carries considerable weight for Australia’s economy. With ongoing discussions among economists about future rate movements, the focus remains on inflation trends and economic growth signals. Many analysts predict that rate cuts may not be on the immediate horizon, as the RBA continues to balance controlling inflation without derailing economic recovery.

As the situation evolves, consumers and businesses alike are encouraged to stay informed about interest rate changes and consider their impacts on financial planning and investment strategies to navigate these challenging times effectively.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.