Latest Insights on ANZ Share Price and Market Trends

Introduction

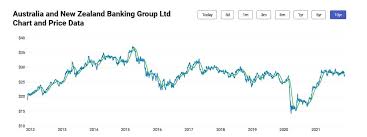

The ANZ share price has garnered significant attention among investors as it reflects the performance of one of Australia’s leading banks. Understanding the fluctuations in the ANZ share price is crucial for investors, analysts, and anyone interested in the Australian financial market. The importance of tracking these changes extends beyond simply trading; it provides insights into the broader economic climate and consumer confidence within Australia.

Current Performance of ANZ Share Price

As of early October 2023, the ANZ share price is reported to be around AUD 25.50, fluctuating within a range of AUD 24.80 to AUD 26.10 over the past month. The recent performance illustrates a slight increase of 3.5% compared to the previous month, which is a positive indicator for shareholders. Analysts attribute this increase to the bank’s robust financial results, which were announced in September, showing improved profit margins and a decrease in bad debts from earlier in the year.

Key Events Influencing the Share Price

Several key events have impacted the ANZ share price recently. In September, ANZ reported a net profit after tax of AUD 3.78 billion for the full year, exceeding analysts’ expectations and marking a significant rebound from the previous period. Furthermore, the Reserve Bank of Australia’s recent interest rate decisions have also played a vital role. As interest rates remain stable, the bank’s lending margins have been positively affected, prompting investor optimism.

Additionally, ANZ’s commitment to technology upgrades and digital transformation has bolstered its competitive edge in a rapidly changing banking landscape. The bank has invested heavily in enhancing its digital banking platforms, which is expected to attract a younger demographic of customers.

Conclusion and Future Forecasts

In conclusion, the ANZ share price currently reflects a sense of stability and growth potential within the financial sector. As the Australian economy continues to recover post-pandemic, many analysts predict that the ANZ share price will experience further increases in the medium to long term. Investors may want to keep an eye on upcoming quarterly reports and global economic conditions that could influence the banking sector. For those considering investing, current trends suggest that ANZ remains a strong candidate given its market position, digital advancements, and favorable financial health.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.