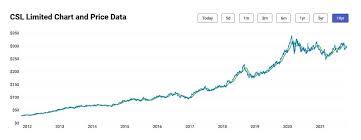

Latest Updates on CSL Share Price Trends

Introduction

The CSL share price is a vital indicator for investors and industry enthusiasts, reflecting the market performance of one of Australia’s leading biotechnology companies. As the COVID-19 pandemic brought the spotlight on biotechnology firms, CSL has positioned itself as a key player in the global market. This article delves into the recent trends and implications surrounding the share price of CSL.

Recent Performance

As of late October 2023, CSL shares have shown notable fluctuations, currently trading around AUD 299.57, which reflects a decrease of approximately 1.2% from the previous week. Analysts attribute some of this volatility to broader market trends and changes in healthcare regulations impacting the biotechnology sector globally. While CSL has faced pressures, its long-standing reputation and diverse product portfolio continue to attract investor interest.

Factors Influencing CSL Share Price

Several factors play a crucial role in shaping the CSL share price. These include:

- Market Trends: Overall market performance can significantly impact individual stocks. The recent bearish trend in global markets has influenced investor sentiment toward CSL.

- Product Pipeline: The strength of CSL’s product pipeline, including developments in treatments for rare diseases and immunoglobulin therapy, is pivotal. Positive news regarding drug approvals can lead to price spikes.

- Financial Reports: Quarterly earnings reports significantly affect share prices. Investors are cautious with upcoming financial disclosures expected to show the company’s performance amidst a challenging economic climate.

Future Outlook

Analysts remain cautiously optimistic about CSL’s long-term prospects despite recent share price declines. With robust growth potential driven by research and development initiatives, CSL is well-positioned to rebound. The market anticipates stronger earnings in the coming quarters, spurred by increasing demand for its products globally.

Conclusion

Tracking the CSL share price is essential for investors looking to navigate the evolving biotechnology landscape. While current fluctuations may cause concern, the company’s solid foundation and commitment to innovation suggest potential for recovery and growth in the future. Staying informed about market trends, product developments, and financial news is key to making strategic investment decisions regarding CSL shares.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.