Understanding the Current ANZ Share Price Trends

Introduction

The Australian and New Zealand Banking Group Limited (ANZ) is one of Australia’s leading financial institutions. As a key player in the banking sector, its share price is a significant indicator of market trends, investor sentiment, and overall economic health. Understanding the latest fluctuations in the ANZ share price is essential for investors, analysts, and anyone interested in the financial markets.

Recent Developments in ANZ Share Price

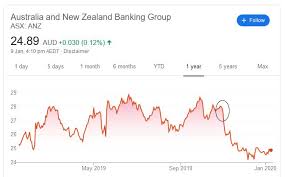

As of mid-October 2023, the ANZ share price has experienced notable volatility, reflecting not only sector-specific challenges but also broader economic influences including interest rate changes and global market sentiments. The share price reached $24.50 AUD, marking a 3% increase over the past month, which analysts attribute to the bank’s recent strong quarterly earnings report.

Factors affecting the ANZ share price include the Reserve Bank of Australia’s (RBA) monetary policy decisions. Recent hints at possible interest rate hikes have led to a positive response from investors anticipating higher profit margins for banks. Moreover, ANZ’s expansion strategy, focusing on digital banking and enhancing customer experience, has also contributed to investor confidence.

Market Sentiment and Economic Indicators

Market analysts indicate that the recent geopolitical events and the performance of major commodities impact the ANZ share price as well. For instance, fluctuations in the Australian dollar and investor reaction to inflation data play crucial roles in shaping market expectations. The financial sector, particularly banks like ANZ, are closely watched indicators of economic recovery or decline.

Conclusion

The current trajectory of the ANZ share price demonstrates the intertwined nature of regional economic policies, market conditions, and investor perceptions. With predictions of fluctuating interest rates and ongoing global uncertainties, investors should remain vigilant regarding factors influencing the share price. Looking ahead, analysts forecast a potential stabilization of the ANZ share price as the market adjusts to economic realities and consumer expectations, making it an essential aspect of monitoring for both current and prospective investors in 2023.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.