ANZ Share Price Analysis: Current Market Position and Future Outlook

Current Market Performance

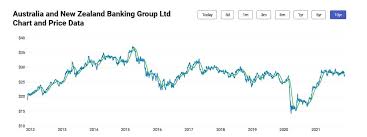

ANZ Group Holdings Limited is currently trading at $32.80, showing a slight decline of 0.46% in the latest trading session. The stock has demonstrated notable volatility, with trading ranging between $32.61 and $33.38, while maintaining a broader 52-week range of $26.22 to $34.09.

Company Overview and Market Position

ANZ Bank, headquartered in Melbourne, Victoria, holds a significant position in Australia’s banking sector as the second-largest bank by assets and fourth-largest by market capitalisation. The bank serves over 8.5 million retail and business customers and maintains operations across nearly 30 markets.

Financial Performance and Analysis

Recent analysis shows that ANZ’s net interest margin (NIM) stands at 1.57%, which is below the major bank average of 1.78%, indicating potential areas for improvement in lending returns. The bank’s return on shareholder equity (ROE) is currently at 9.3%, translating to $9.30 in yearly profit for every $100 of shareholder equity.

Market Outlook and Analyst Perspectives

Based on assessments from 10 Wall Street analysts over the past three months, ANZ has received an average price target of AU$28.29, with projections ranging from AU$26.39 to AU$31.20. This represents a potential adjustment from the current trading price. Current analyst ratings show a mixed outlook, with 2 Buy Ratings, 15 Hold Ratings, and 3 Sell Ratings.

Business Strategy and Future Direction

The bank has notably shifted its strategy, moving away from its previous super-regional Asian focus to concentrate on higher-returning businesses in Australia and New Zealand. While maintaining some presence in Asia, ANZ has evolved into a more balanced and better-capitalized institution with a simplified operational structure.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.