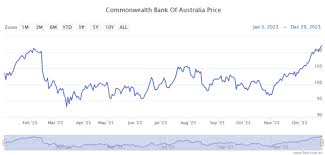

The Current Landscape of CBA Shares in Australia

Introduction to CBA Shares

The Commonwealth Bank of Australia (CBA) is one of the country’s leading financial institutions, and its shares are a significant component of the Australian stock market. As the largest bank in Australia by market capitalization, CBA shares are closely watched by investors and analysts alike. Understanding the trends and movements in CBA shares is crucial for both seasoned investors and those new to the stock market, as it can provide insights into larger economic conditions and trends within the banking sector.

Recent Performance of CBA Shares

As of October 2023, CBA shares have shown resilience in a fluctuating market. Over the past month, the share price has experienced some volatility, reflecting broader economic uncertainties and interest rate fears as the Reserve Bank of Australia grapples with inflation concerns. On October 10, 2023, CBA shares were trading at approximately AUD 103, having shown a mild increase of 2.5% over the last quarter. Analysts attribute this uptick to stronger-than-expected quarterly earnings, which showcased robust growth in home loan approvals and an increase in business lending.

Factors Influencing the Stock Movement

Several factors are currently influencing the CBA share price, including federal economic policies, changes in interest rates, and international market conditions. The Australian economy has been facing challenges due to rising inflation, which has caused the Reserve Bank to adjust interest rates multiple times this year. Higher interest rates historically lead to increased costs of borrowing, potentially impacting CBA’s loan growth and profitability.

Additionally, investor sentiment remains crucial; positive news related to government policies supporting the banking sector can bolster share prices while negative news can lead to quick sell-offs. According to financial analysts at Morgan Stanley, sustained growth in customer deposits and a shift towards digital banking services are viewed as positive indicators for CBA shares moving forward.

Conclusion and Future Outlook

In conclusion, CBA shares remain an essential investment choice within the Australian market, despite the surrounding economic complexities. Investors are advised to keep an eye on ongoing developments, including interest rate decisions and economic growth indicators, which will significantly influence future share performance.

With the anticipated expansion into new digital services and strategic acquisitions, analysts forecast potential growth in CBA shares over the next fiscal year. For current and prospective investors, CBA shares may represent both risks and opportunities, highlighting the importance of conducting thorough research and staying informed about market trends.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.