Understanding TLS ASX: Telstra Corporation Limited Insights

Introduction

The Australian Stock Exchange (ASX) plays a pivotal role in the country’s economy, and one of the most significant entities listed on this exchange is Telstra Corporation Limited (TLS). As Australia’s leading telecommunications company, Telstra’s performance on the ASX is closely monitored by investors and analysts alike, making it a focal point of discussion in financial arenas. Understanding the developments surrounding TLS ASX is crucial for stakeholders, especially in the wake of recent market fluctuations and technological advancements.

Recent Developments

Telstra has been undergoing a substantial transformation to adapt to the ever-evolving telecommunications landscape. In its latest quarterly report, Telstra reported a 5% increase in revenue, driven by a surge in demand for its mobile and internet services. The firm has also made significant strides in improving its customer service and network reliability, which have yielded positive responses from consumers.

Additionally, Telstra has announced cuts to mobile plan prices and an expansion of its 5G network, which is expected to reach 95% of the Australian population by mid-2024. These strategic moves are likely aimed at retaining current customers and attracting new ones amid competitive pressure from rivals such as Optus and Vodafone.

Market Performance

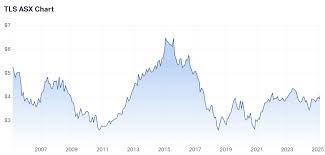

As of October 2023, TLS ASX shares have shown a resilient performance despite broader market volatility. The stock price recently hovered around AUD 4.80, reflecting a stabilisation after a tumultuous period earlier in the year where shares fell due to regulatory concerns. Analysts suggest that Telstra’s investment in 5G technology and its focus on operational efficiency could bolster future growth and positively affect the share price.

The company’s dividend yield remains an attractive feature for investors, currently standing at approximately 4.5%. In an environment where fixed interest returns are low, Telstra’s dividend offers considerable appeal, enhancing its value proposition for long-term investors.

Conclusion and Future Outlook

The importance of monitoring TLS ASX cannot be overstated, particularly with Telstra’s ongoing initiatives in network expansion and customer engagement. As the 5G rollout accelerates and new technologies emerge, Telstra is poised for significant growth in the coming years. Analysts predict that if the momentum continues, Telstra can regain its previous highs and possibly even surpass them, providing lucrative opportunities for investors.

In conclusion, Telstra Corporation Limited stands at a crucial juncture with its focus on technological innovation and market adaptation. Stakeholders should remain alert to any announcements from the company, as they may significantly influence the stock’s trajectory on the ASX.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.