Exploring the Role of ING Bank in the Australian Financial Landscape

Introduction

ING Bank, an integral player in the Australian banking sector, operates under a direct banking model that has revolutionised how Australians manage their finances. Established in 1999 in Australia, ING has grown significantly, aiming to provide competitive rates while keeping customer service at the forefront. As digital banking becomes increasingly vital, the relevance of ING in today’s economy cannot be overstated.

ING’s Growth and Services

Initially known for its savings accounts and term deposits, ING has expanded its repertoire to include home loans, personal loans, and business banking solutions. The bank’s Australian operations have embraced technology, offering an intuitive online banking platform that is secure and user-friendly.

As of 2023, ING has over 1.5 million customers in Australia. The bank is renowned for its attractive interest rates, often leading the market with headline rates on savings accounts. Recently, ING has also been focusing on sustainability as part of its core values, investing in green loans and supporting environmentally friendly projects.

Economic Impact

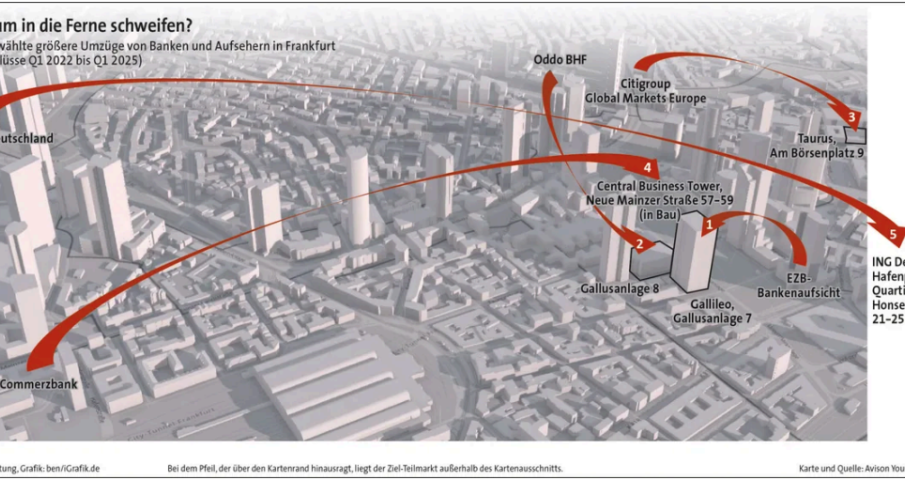

ING has played a pivotal role in promoting competition in the Australian banking sector. Its presence has led to lower rates and better services as traditional banks react to its innovative offerings. In recent months, ING has witnessed substantial growth in its lending segment, particularly amid rising property prices and a competitive housing market. A recent report highlighted that ING has increased its market share in the home loan sector, capturing the interest of first-time homebuyers and those looking to refinance.

Conclusion

As Australia continues to navigate a rapidly changing financial landscape, the significance of ING Bank remains clear. Its commitment to customer service, competitive rates, and innovative digital banking solutions positions it as a frontrunner in the industry. Looking ahead, ING is likely to expand its service offerings, focusing on sustainable finance while continuing to foster competition within the banking sector. For consumers, this means not only better financial products but also enhanced service quality, reflecting the dynamic evolution of banking in Australia.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.