Understanding RBA Rate Cuts and Their Economic Impact

Introduction

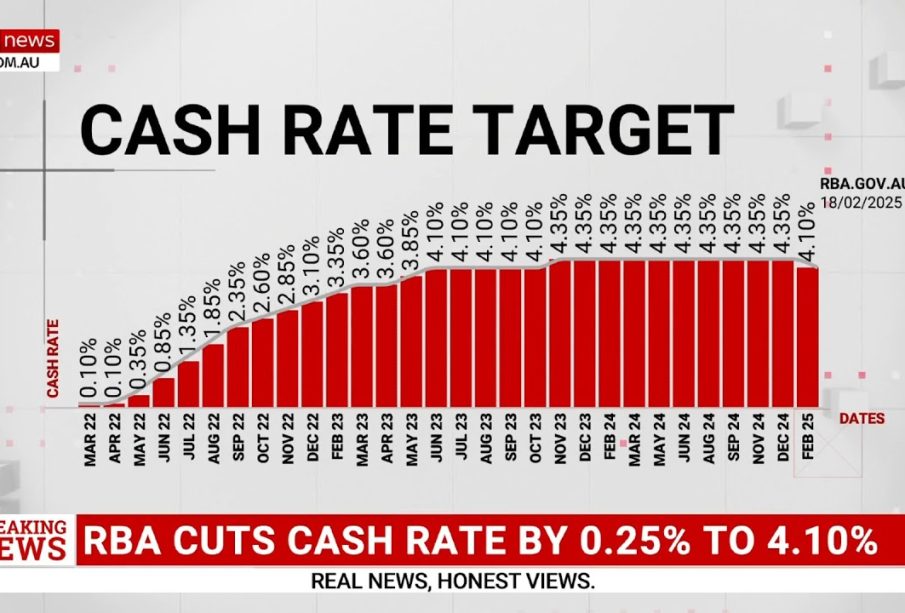

The Reserve Bank of Australia (RBA) is the country’s central bank, and its decisions regarding interest rates are crucial for economic stability. Recently, discussions around RBA rate cuts have gained traction among economists and consumers alike. As Australia navigates through a recovery phase amid global economic uncertainties, understanding the implications of these potential rate cuts is vital for both borrowers and savers.

Current Economic Landscape

As of October 2023, Australia has experienced fluctuating inflation rates amidst various economic challenges, including the aftermath of the COVID-19 pandemic and rising living costs. In its latest meeting, the RBA hinted at the possibility of rate cuts in response to slowing economic growth and a goal of stimulating consumer spending. A lower cash rate is aimed at making borrowing cheaper, thereby encouraging spending and investment.

Recent data from the Australian Bureau of Statistics shows that consumer confidence is waning, with the household savings rate declining as many families grapple with increased costs of living. The RBA aims to counter this trend through monetary policy adjustments. Rate cuts could provide much-needed relief to mortgage holders and businesses, fostering a more optimistic economic outlook.

Potential Effects of Rate Cuts

If the RBA proceeds with rate cuts, several immediate effects can be anticipated. Borrowers may see reductions in their mortgage repayments, leading to increased disposable income and spending power. This, in turn, could boost retail sales and stimulate job growth, helping to revive sectors hit hardest by the pandemic.

Conversely, for savers, particularly retirees who rely on interest income, rate cuts could lead to diminished returns on savings accounts and fixed deposits. Financial planners urge savers to reassess their investment strategies in a low-interest environment, as traditional savings pathways may become less lucrative.

Conclusion

The potential for RBA rate cuts reflects the central bank’s commitment to navigating Australia through challenging economic circumstances. While rate cuts could provide a significant boost to borrowers and the economy, they also pose challenges for savers and investors. As the RBA continues to evaluate economic indicators, stakeholders across all sectors should remain informed and prepared for the changes ahead. Monitoring upcoming RBA meetings and economic updates will be essential for making informed financial decisions.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.