Latest Trends in BHP Share Price: An Overview for Investors

Introduction

The BHP Group, one of the world’s largest mining companies, has been a significant player in the Australian stock market. With the fluctuating global economy and evolving commodity prices, monitoring the BHP share price has become increasingly important for investors and analysts alike. Understanding these dynamics can provide valuable insight into potential investment opportunities.

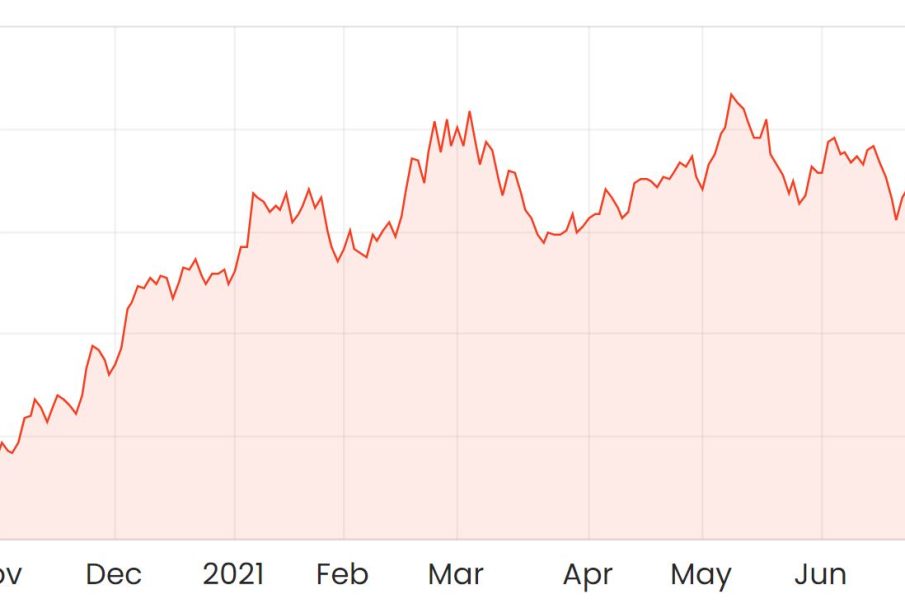

Current Trends in BHP Share Price

As of October 2023, the BHP share price has seen notable volatility, reflecting broader market trends and the performance of key commodities that BHP is involved with, such as iron ore, copper, and coal. Recent reports from the Australian Securities Exchange (ASX) indicate that BHP shares have fluctuated between AUD 40 and AUD 45 over the past month.

Factors influencing this price range include the falling demand from China, a major consumer of iron ore, and fluctuating energy prices as countries ramp up efforts for sustainable energy. The global economic outlook is also affecting market sentiment, with concerns about recession impacting investor confidence.

Key Market Influences

In recent weeks, several announcements from BHP regarding production outputs and operational adjustments have also played critical roles in shaping the share price. The company announced a slight decrease in iron ore production due to maintenance schedules at its Western Australian mines, which caused a temporary dip in stock value.

On the other hand, BHP’s strategic decisions related to sustainability initiatives and green energy investment have fostered optimism among investors. These efforts are expected to position the company favorably in the long run, particularly as governments worldwide push for decarbonization.

Conclusion

The current BHP share price is being closely monitored by market analysts and investors, given its potential for both short-term volatility and long-term stability based on strategic ventures. While the immediate outlook remains cautious due to global economic challenges, BHP’s commitment to sustainability and operational efficiency may lend support to its stock value in the future. Investors are advised to remain vigilant, as ongoing news regarding commodity prices and market conditions will undoubtedly influence BHP’s share price in the coming months. Keeping abreast of such changes will be essential for anyone interested in investing in one of Australia’s largest corporations.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.