Latest Insights on RBA Interest Rates in Australia

The Importance of RBA Interest Rates

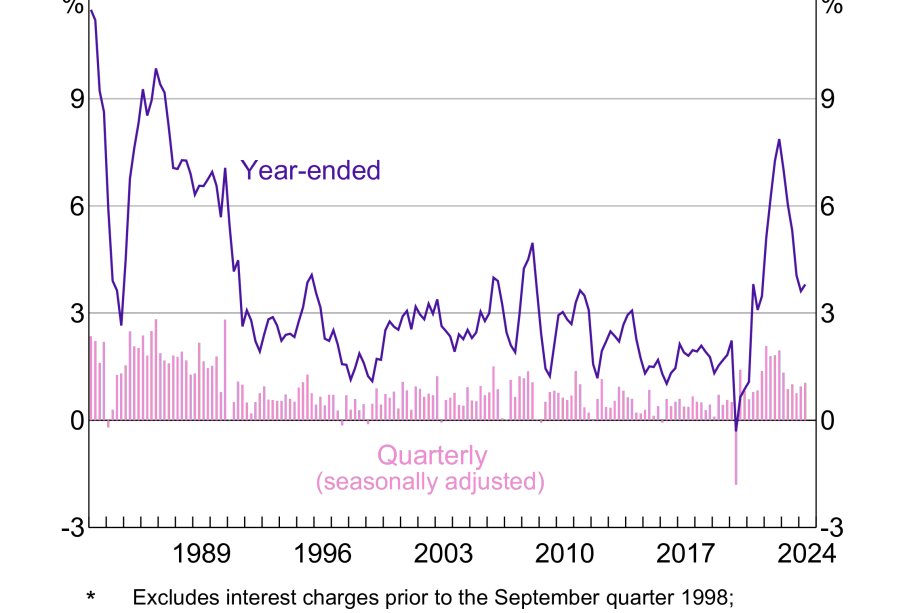

In the context of Australia’s economy, the Reserve Bank of Australia (RBA) plays a crucial role in stabilising financial markets and influencing economic growth through its monetary policy, particularly via interest rates. As of October 2023, interest rates are a focal point for consumers, businesses, and economists alike, especially in light of rising inflation and changing economic conditions.

Current Rate Decisions

In its most recent monetary policy meeting held on October 3, 2023, the RBA decided to raise the benchmark interest rate by 25 basis points, bringing it to 4.00%. This decision was fuelled by concerns over persistently high inflation, which has remained above the RBA’s target range of 2-3%. The RBA Governor, Philip Lowe, stated, “Inflation continues to exceed our target range, and this further increase in interest rates is necessary to ensure inflation is brought back under control.” This marks the 11th consecutive rate hike since interest rates were lowered during the pandemic.

Impacts on the Economy

The rise in interest rates is likely to have a multifaceted impact on the Australian economy. Homeowners with variable rate mortgages will face increased repayments, which may affect consumer spending habits. Economists suggest that while higher interest rates can help cool inflation, they may also slow down economic growth, as businesses may postpone investments and hiring due to higher borrowing costs. The impact is particularly significant for first-time homebuyers and those in the housing market, who are facing affordability pressures.

Future Outlook

Looking forward, financial experts are predicting that the RBA may need to maintain higher interest rates for some time to ensure inflation is kept in check. Analysts expect the rates to remain elevated at least until mid-2024, depending on external economic conditions and domestic inflation rates. The broader message from the RBA is clear: inflation control remains a priority, and interest rates will be adjusted as necessary in response to economic developments.

Conclusion

The landscape of interest rates in Australia is complex and continuously evolving. With the RBA’s commitment to tackling inflation, borrowers and investors must stay informed about potential shifts in policy. Understanding the implications of interest rates can help individuals and businesses make more informed financial decisions as they navigate this challenging economic environment. As market conditions change, the RBA’s future rate decisions will be closely monitored by all economic stakeholders, serving as a key determinant for the financial health of many Australians.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.