Understanding CSL Share Price Trends and Insights

Importance of Monitoring the CSL Share Price

The CSL Limited (ASX: CSL) share price is a significant indicator for investors and analysts, particularly in the healthcare sector. Understanding its fluctuations can provide insights into the company’s performance and the broader market trends affecting biotech and pharmaceutical companies. CSL is one of the largest global biopharmaceutical companies in Australia, producing medications derived from human blood plasma, and its stock performance is closely tracked by both institutional and retail investors.

Current Performance of CSL Share Price

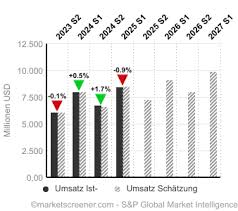

As of October 2023, the CSL share price has shown notable stability despite market volatility influenced by economic factors like inflation and interest rates. Trading around AUD $300 per share, CSL has seen a robust performance attributable to its strong fundamentals and expanding product portfolio. The company recently announced positive results from clinical trials of its new drugs, reinforcing investor confidence and driving the share price upward.

Market Trends Influencing CSL Share Price

Global healthcare demand, especially post-pandemic, continues to bolster the growth trajectory of pharmaceutical companies like CSL. Additionally, the ongoing advancements in biotechnology are likely to enhance their operational capabilities, thereby fueling further investment interest. Analysts observe that CSL’s diversification into areas such as oncology and immunology has positioned the company well to navigate economic downturns effectively.

Future Outlook and Predictions

Looking forward, the consensus among market analysts suggests an optimistic outlook for the CSL share price in the coming year. Factors such as potential new drug approvals, strategic partnerships, and market expansion initiatives could contribute to continued growth. However, challenges like regulatory obstacles and global supply chain disruptions remain potential risks. Investors are encouraged to remain informed about industry developments and to consider these factors when evaluating CSL’s stock performance.

Conclusion

In conclusion, keeping a close watch on the CSL share price is vital for stakeholders in the healthcare investment landscape. With a strong pipeline of products and an adaptive business strategy, CSL is poised for sustained growth. As such, monitoring their share price trends will remain crucial for informed investment decisions in the dynamic biotech sector.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.