Important ATO Tax Return Warning for Australians in 2023

Understanding the ATO Tax Return Warning

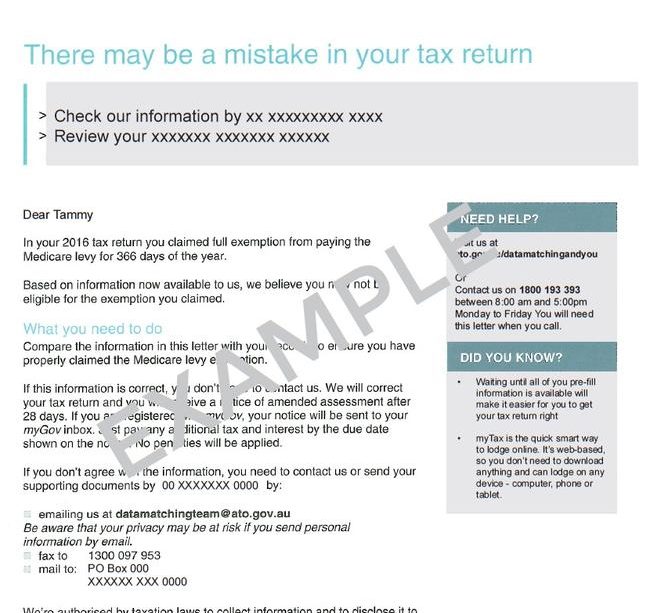

The Australian Taxation Office (ATO) has recently issued an important warning regarding tax returns for the 2023 financial year, underscoring the significance of accurate reporting and compliance. This notice aims to inform Australians that the ATO will be closely scrutinising tax returns this year, as part of its ongoing effort to enforce tax laws more rigorously.

Key Issues Highlighted by the ATO

One of the main concerns raised by the ATO is related to common errors made on tax returns. These include incorrect claims for deductions, categorisation of income, and failure to report income from side jobs or gig economy activities. Furthermore, the ATO has noted that individuals claiming a higher than average percentage of expenses relative to their income will face increased scrutiny.

Moreover, the ATO is utilising enhanced data matching technologies to identify discrepancies in tax returns. According to a statement from the Commissioner of Taxation, “We have access to more data than ever before, and we will use it to increase compliance.” This marks a significant shift in how the ATO conducts tax audits, as they broaden their approach to tax compliance through advanced analytics and information sharing.

Implications for Taxpayers

The implications for taxpayers are clear; Australians need to be meticulous in preparing and filing their tax returns this year. Those who intentionally or unintentionally underreport their taxes could face significant penalties, including fines, interest charges, or even criminal charges in severe cases.

Tax financial advisors are urging individuals to review their previous claims and seek professional assistance if they are unsure about their entitlements. It is recommended that taxpayers keep well-organised records of all income and expenses throughout the year, to avoid discrepancies when filing returns.

Looking Ahead

As tax season approaches, it is essential for Australians to stay updated on the ATO’s guidance and to comply with their tax obligations. For those who have not filed their returns yet, the ATO encourages early lodgement to avoid any last-minute issues. The deadline for individual tax returns is typically 31 October, and late submissions can incur penalties.

Conclusion

In conclusion, the ATO tax return warning for 2023 serves as a critical reminder for taxpayers to be diligent in their reporting. With the ATO’s increased scrutiny and advanced data analysis techniques, taxpayers should approach their tax returns seriously. By ensuring compliance and accuracy, Australians can minimise the risk of penalties and contribute to the overall integrity of the tax system.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.