Understanding the Current Australian Inflation Rate

Introduction

The Australian inflation rate is a critical economic indicator that influences the cost of living, consumer spending, and monetary policy decisions. With the ongoing shifts in the global economy and various challenges, understanding the current trends in inflation is crucial for consumers, businesses, and policymakers alike.

Current Trends in Australian Inflation

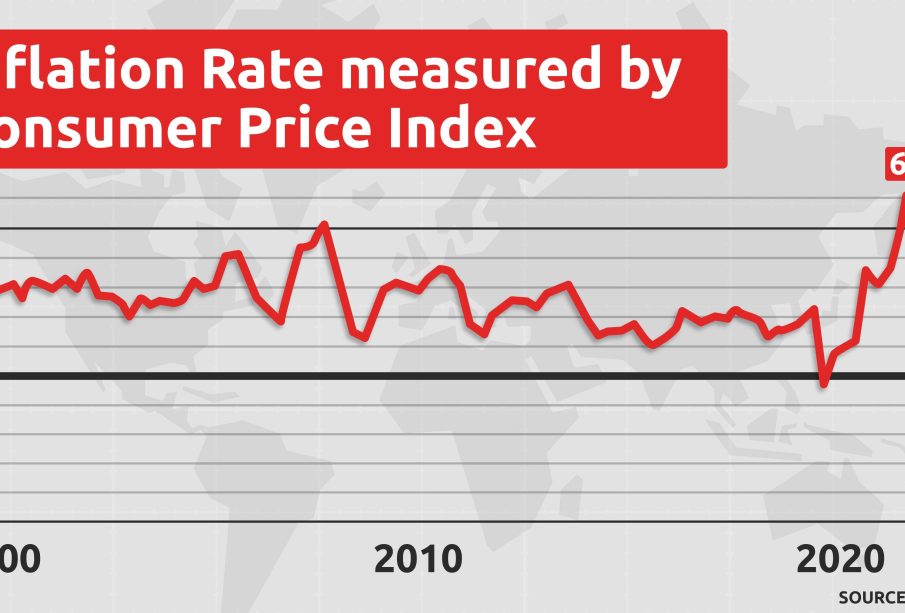

As of the latest data released by the Australian Bureau of Statistics (ABS) in October 2023, the annual inflation rate stands at 5.4%, a slight decrease from the 6.1% recorded earlier in the year. This decline can be attributed to stabilising supply chains and easing costs in various sectors, notably energy prices and transport. Nonetheless, the inflation figure remains above the Reserve Bank of Australia’s (RBA) target range of 2% to 3%, signalling persistent inflationary pressures in the economy.

Factors Influencing Inflation

Several factors contribute to the current inflation rate in Australia. The global energy crisis, exacerbated by geopolitical tensions and post-pandemic recovery, continues to impact fuel and electricity prices. Additionally, rising wages through labour shortages in certain sectors have exerted upward pressure on prices. Consumer demand also remains strong, despite higher costs, as households adapt to wage increases and a robust job market.

Implications for Households and Businesses

The implications of the current inflation rate are vast. Households face increased costs of living, impacting their purchasing power and savings. The rising inflation has led to interest rate hikes by the RBA, which has raised the official cash rate to 4.1% in an effort to curb spending and inflation. For businesses, particularly small enterprises, rising input costs can lead to decreased margins and challenges in pricing strategies.

Outlook for the Future

Looking ahead, economists predict a gradual decrease in the inflation rate as supply chains improve and global pressures ease. The RBA’s monetary policy is likely to remain cautious, focusing on balancing inflation control with economic growth to mitigate potential recessions. Financial analysts are closely monitoring inflation data as it plays a pivotal role in shaping the economic landscape and influencing consumer confidence going forward.

Conclusion

In conclusion, the current Australian inflation rate remains a significant topic that directly affects citizens and businesses. As inflation rates continue to fluctuate, staying informed will be crucial for navigating future economic challenges. Understanding these trends helps individuals and policymakers make more informed decisions in both the short and long term.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.