Understanding the Current Australian Inflation Rate

Introduction

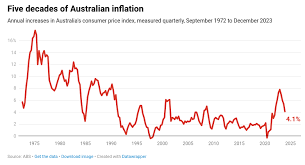

The Australian inflation rate stands as a critical indicator of the economy’s health, affecting everything from purchasing power to monetary policy decisions. As Australia navigates post-pandemic economic recovery, understanding the factors influencing inflation is vital for consumers, businesses, and policymakers alike. With inflation rates recently reaching levels not seen in decades, examining the current landscape sheds light on broader economic implications.

Current Inflation Trends

As of October 2023, Australia’s annual inflation rate is reported at 5.2%, down from a peak of 7.8% reached in late 2022. This decrease hints at the effectiveness of the Reserve Bank of Australia’s (RBA) monetary tightening measures, including interest rate hikes aimed at slowing down the economy. The RBA has increased the cash rate to 4.5%, the highest level since 2012, targeting inflation control.

Key contributors to the inflation rate have included fluctuations in energy prices, housing costs, and food prices. Australia’s energy crisis, largely spurred by global supply chain disruptions and geopolitical tensions, has seen electricity and gas prices soar, adding pressure to household budgets. Moreover, the ongoing impacts of workforce shortages and supply chain constraints continue to drive up costs in the food sector.

Impacts on Consumers and Businesses

For Australian households, rising inflation translates to increased costs for everyday essentials. This economic reality forces many consumers to adjust their spending habits, prioritising needs over wants. A recent survey highlighted that 78% of Australians have started to cut back on discretionary spending, a trend that could have long-term implications for local businesses and the broader economy.

Conversely, businesses are grappling with the dual challenge of rising input costs and shifting consumer behaviour. Many companies are passing on these costs to consumers in the form of higher prices, leading to a cycle that can further fuel inflation. Small and medium enterprises, in particular, are feeling the pinch as they struggle to keep up with larger competition capable of absorbing some costs.

Looking Ahead: Forecasts and Significance

Experts suggest that inflation rates may stabilise toward the end of 2023, with predictions of a gradual easing back toward the RBA’s target range of 2-3%. However, this remains heavily dependent on external factors, including global economic conditions and domestic policy responses. The current inflation situation will likely inform RBA decisions, particularly regarding future interest rate adjustments.

In conclusion, the Australian inflation rate is a pivotal factor influencing both consumer and business environments. Understanding its trends and impacts is essential for making informed financial decisions. As the economy continues to adjust, the path forward remains uncertain, underscoring the importance of active monitoring for all stakeholders involved.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.