Understanding the Current Trends in S&P 500 Performance

Introduction

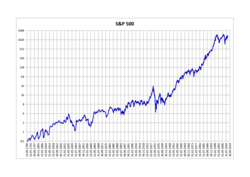

The S&P 500, a vital stock market index tracking the performance of 500 of the largest publicly traded companies in the United States, serves as a critical barometer of the overall health of the stock market and the economy. Investors, analysts, and economists closely monitor the S&P 500 for insights into market trends, investor sentiment, and potential economic direction. As of October 2023, the index continues to evolve, influenced by various factors that shape market dynamics.

Recent Performance Trends

As of the latest reports, the S&P 500 has exhibited fluctuating performance, chiefly influenced by inflation concerns, interest rate adjustments by the Federal Reserve, and global economic uncertainty. Following a robust economic recovery post-pandemic, the index witnessed significant volatility in 2023. Notably, after reaching a peak earlier in the year, it has shown signs of correction in response to increasing interest rates aimed at curbing inflation.

In September 2023, the S&P 500 faced a minor downturn, closing down approximately 3% for the month amidst renewed fears of persistent inflation and potential recessionary signals. Despite this, sectors such as technology and healthcare have shown resilience, continuing to attract investor interest and demonstrating that not all company performances are directly tied to broader economic indicators.

Key Influencing Factors

Several factors have played a crucial role in shaping the S&P 500’s trajectory:

- Interest Rates: The Federal Reserve has implemented a series of interest rate hikes to combat inflation. These adjustments have led to market recalibrations, affecting borrowing costs for businesses and consumers alike.

- Corporate Earnings: Investors closely scrutinise quarterly earnings reports from S&P 500 companies. Strong earnings from major firms can bolster market confidence, while disappointing results can lead to sell-offs.

- Global Economic Outlook: Supply chain disruptions and geopolitical tensions continue to affect market sentiment. Events such as the conflict in Ukraine and trade relations with China add layers of complexity to investment strategies.

Conclusion

The S&P 500 remains an essential index for gauging market health and economic conditions. As we approach the final quarter of 2023, investors should remain vigilant and informed about the factors influencing market performance. While the index has experienced fluctuations, the long-term outlook will depend greatly on inflation management, corporate earnings, and broader economic indicators. Looking ahead, market experts predict that careful monitoring of these elements will be crucial to understanding the S&P 500’s path and the potential opportunities it may present.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.