Understanding the Australian Auction Market Downturn

Introduction

The Australian real estate market, long viewed as a thriving landscape for property investment, is currently experiencing a significant downturn, particularly in the auction segment. This shift in market dynamics has sent ripples of uncertainty through potential buyers and investors alike, as economic conditions, increasing interest rates, and changing buyer sentiment influence outcomes at auction houses across the nation.

Current Trends in the Auction Market

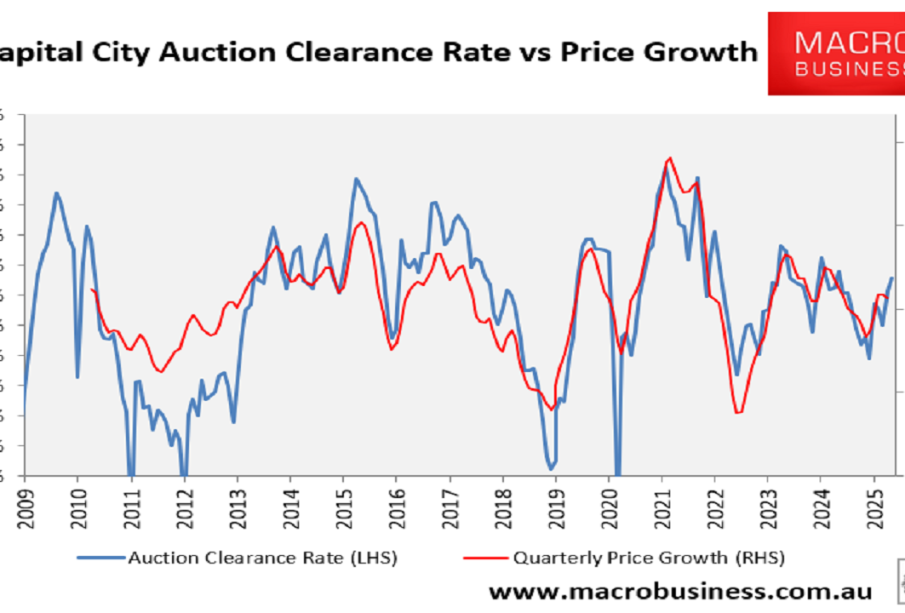

Recent statistics from the Australian Property Monitors reveal that clearance rates in major cities such as Sydney and Melbourne have fallen sharply. In October 2023, Sydney recorded a clearance rate of just 60%, down from 75% a year prior. Melbourne saw a similar trend, with rates plummeting from 70% to 58%.

Industry experts attribute this downturn to a combination of factors. Firstly, the Reserve Bank of Australia has implemented a series of interest rate hikes in response to rising inflation, making borrowing more expensive for prospective home buyers. This has resulted in a decrease in auction attendance as many buyers reconsider their purchasing power. Additionally, the ongoing economic uncertainty surrounding job security and inflation has left many Australians hesitant to make substantial financial commitments.

Impact on Property Prices

As a result of decreased buyer participation in auctions, many property listings are experiencing price reductions. CoreLogic reports that property prices in Sydney have decreased by 5% over the past six months, while Melbourne has seen a similar decline of around 4%. For sellers, this means adjusting expectations and being prepared for offers significantly lower than what the market commanded just a year ago.

Changing Buyer Sentiment

With the auction market downturn, buyer sentiment appears to be shifting from aggressive bidding wars to a more cautious approach. According to a survey conducted by the Real Estate Institute of Australia, 67% of respondents indicated they are waiting for further price corrections before entering the market, indicating a significant pause in transaction activity.

Conclusion

The downturn in the Australian auction market signifies a notable change in the property landscape. While current statistics may paint a bleak picture, analysts suggest that this pause could provide an opportunity for first-time buyers and investors to enter the market at a potentially lower cost. As the economic environment stabilises, there may be a gradual recovery in buyer confidence, leading to a potential revival of auction activity in late 2024. Stakeholders in the real estate sector will need close monitoring of these trends to adapt strategies and navigate the evolving market.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.