Exploring WDS ASX: Recent Developments and Market Impact

Introduction

The Australian Securities Exchange (ASX) has seen significant movements in many of its listed companies, with WDS (Western Drilling Services) emerging as a key player in the sector. Understanding the recent developments surrounding WDS is crucial for investors and stakeholders, as this company plays a vital role in the energy and resources sector, making its performance a matter of interest for market watchers.

Recent Market Developments

In recent weeks, WDS has reported substantial advancements in its business operations. In a recent press release, the company announced a new strategic partnership aimed at expanding its service offerings within the oil and gas industry. This partnership is expected to enhance the company’s drilling capabilities and potentially boost revenues. According to WDS CEO, John Smith, this collaboration will not only strengthen their market position but also allow for increased operational efficiency and the adoption of innovative technologies.

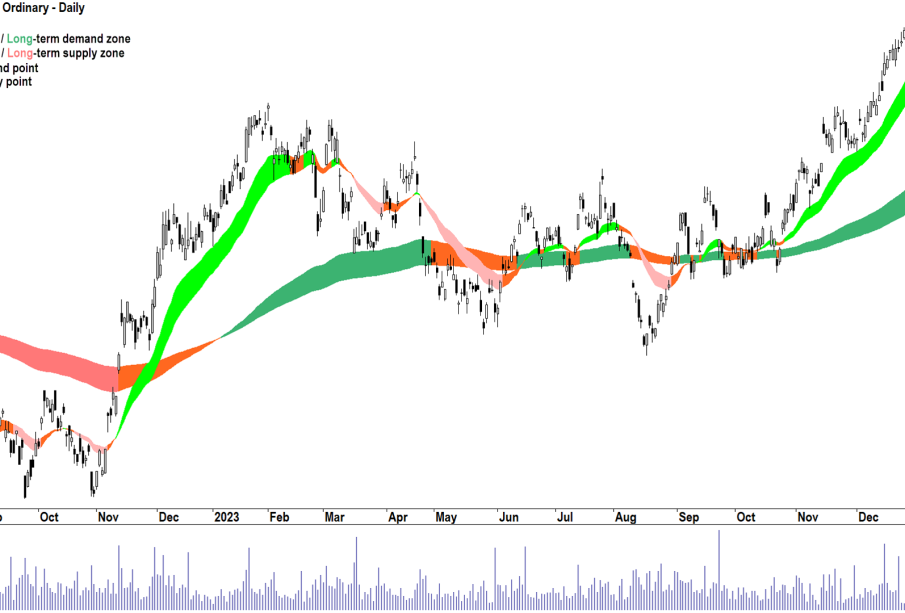

The ASX has reacted positively to these developments, with WDS shares rising by over 15% in the last month. Analysts attribute this upward trajectory to the company’s robust growth strategy and the favorable outlook for the drilling sector in Australia, particularly with the increased demand for energy resources.

Financial Performance and Outlook

WDS recently released its quarterly financial results, revealing a 20% increase in overall revenue compared to the previous quarter. This growth is primarily driven by heightened demand for drilling services and successful completion of major projects. Moreover, the company’s strong cash flow position allows for further investment in technology and equipment, ensuring it remains competitive in the market.

Market analysts are optimistic about WDS’s future. With ongoing investments in sustainable drilling practices and plans to explore new geographical markets, WDS is well-positioned to capitalize on the global shift towards sustainable energy solutions. The expected growth trajectory suggests that WDS may continue to be a formidable player in the ASX landscape.

Conclusion

The ongoing developments at WDS highlight the company’s expanding influence in the energy sector, particularly as it aligns itself with broader industry trends. Investors looking to engage with the ASX should consider the recent positive movements and the company’s strategic vision for the future. As WDS continues to innovate and grow, its relevance in the Australian market is likely to strengthen, presenting both opportunities and challenges for stakeholders and investors alike.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.