Analyzing Current Trends in Apple Share Price

Introduction

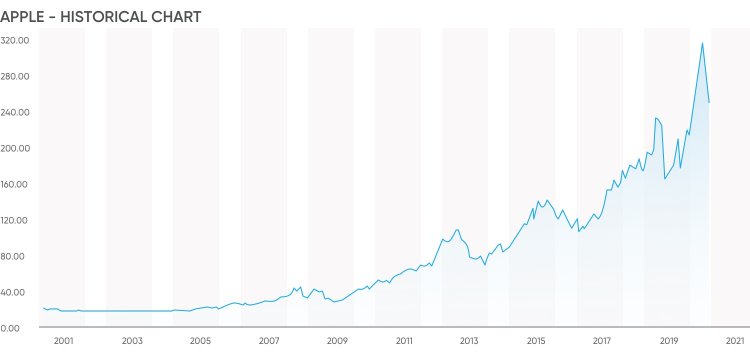

The Apple share price is a barometer for not just the technology sector but the overall health of the stock market. As one of the largest companies in the world by market capitalization, fluctuations in its stock can have significant implications for investors and the economy. Recently, Apple Inc. has garnered attention due to its evolving business strategy and shifts in consumer technology demands, making the current share price an important focus for analysts and investors alike.

Recent Performance of Apple Share Price

As of late October 2023, Apple shares are trading at approximately AUD 192, showing a modest increase of 3% compared to the previous month. Analysts attribute this rise to strong quarterly earnings that exceeded expectations, driven primarily by an increase in services revenue and continued demand for iPhones. Specifically, Apple reported a remarkable growth of 15% in its services division, which includes offerings like Apple Music and iCloud.

Apple’s stock price saw a temporary dip earlier in the month due to concerns over supply chain disruptions and a slowdown in consumer spending on electronics. However, the overall sentiment appears to be shifting positively as the company reassures investors with its plans for expansion into new software services and a potential roll-out of innovative devices in the coming quarters.

Market Influencers and Analysts’ Insights

Investors are eyeing various factors that could influence the Apple share price in the near future. Firstly, global economic conditions post-pandemic have resulted in cautious consumer spending, particularly for high-end technology products. Additionally, inflation rates and interest rate hikes are key variables impacting overall market performance and investor sentiment.

Furthermore, analysts remain generally optimistic about Apple’s stock. A report from a leading financial firm projected that Apple shares could rise to AUD 220 by the end of the year, contingent on sustained product demand and successful new releases. This follows a broader trend of tech stocks recovering from previous losses earlier in the year, suggesting that investor confidence is gradually returning.

Conclusion and Future Outlook

In conclusion, the current state of the Apple share price reflects both challenges and opportunities within the technology sector. Investors should remain informed about the market trends and economic conditions that influence this major player. As Apple adapts to changes in consumer behaviour, invests in innovative technologies, and navigates the complexities of global supply chains, the share price may continue to fluctuate. However, the sentiment remains predominantly positive, suggesting a potential upward trajectory in the coming months. For current and future investors, keeping an eye on Apple’s performance will be crucial for making informed decisions in their portfolios.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.