Understanding ANZ on the ASX: Latest Insights and Developments

Introduction

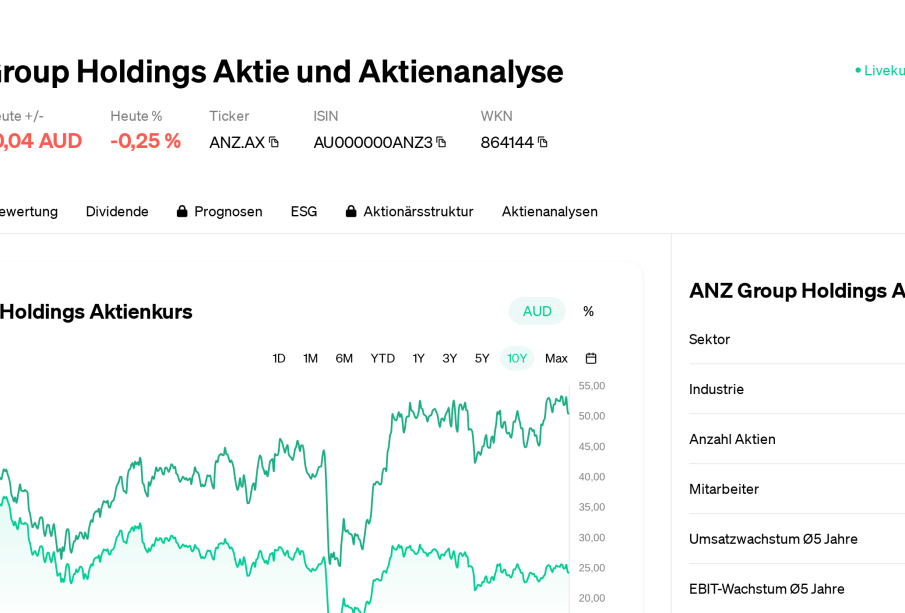

The ANZ (Australia and New Zealand Banking Group) is one of the Big Four banks in Australia and plays a crucial role in the country’s financial sector. Its shares are traded on the Australian Securities Exchange (ASX) under the code ANZ. The performance of ANZ on the ASX is significant not only for investors but also for the broader economy and financial markets in Australia. As the economy navigates post-pandemic recovery and challenges such as inflationary pressures, understanding the trends associated with ANZ’s stock is essential for both individual investors and financial analysts.

Current Performance and Key Developments

As of October 2023, ANZ’s stock has shown fluctuations reflecting both market conditions and the bank’s strategic decisions. Recently, ANZ reported a 3% rise in net profit for the financial year ending September 2023, driven by increased lending and higher interest margins. Analysts cite this positive performance as indicative of the bank’s robust operational capabilities amidst a challenging economic environment.

In recent weeks, the ANZ board announced a series of strategic initiatives aimed at streamlining operations and enhancing digital banking solutions, further positioned to attract a younger clientele. Additionally, the bank plans to invest $1 billion in technology upgrades over the next three years, which could significantly improve efficiency and customer experience.

Factors Influencing ASX Performance

Factors impacting ANZ’s performance on the ASX include economic indicators, regulatory changes, and shifts in consumer behaviour. Consequently, rising interest rates are expected to bolster the bank’s profit margins; however, they may also slow down borrowing, which could have a nuanced effect on long-term growth.

Moreover, the global economic landscape, including geopolitical tensions and commodity prices, adds another layer of complexity to ANZ’s market performance. Local analysts predict that while ANZ is well-positioned to weather economic storms, ongoing vigilance regarding market trends is essential.

Conclusion

The outlook for ANZ on the ASX remains cautiously optimistic. The combination of solid financial performance, strategic investments in technology, and proactive management suggests that ANZ could continue to thrive despite external challenges. For investors and stakeholders, keeping a close eye on the bank’s quarterly performances and market conditions will be crucial in making informed decisions. Overall, ANZ’s role in the ASX serves as a reflection of broader economic trends, making its stock a key focus in the evolving Australian financial landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.