Understanding the Current Bitcoin Price in USD

Introduction

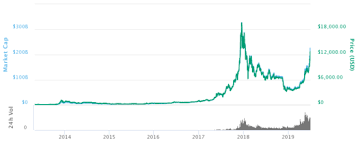

The price of Bitcoin, the first and most well-known cryptocurrency, has seen significant fluctuations since its inception in 2009. With rising interest from investors and mainstream financial systems adopting cryptocurrency, understanding the current trends in Bitcoin price in USD has become vital for both investors and financial analysts. Tracking these trends can offer insights into market sentiments, technological advancements, and economic factors affecting this digital asset.

Recent Trends in Bitcoin Price

As of the latest reports, Bitcoin is trading at approximately $26,000 USD, a figure that has demonstrated considerable volatility over the past year. In early 2023, Bitcoin reached prices as high as $45,000 but saw a sharp decline mid-year due to regulatory uncertainties and market corrections. However, the latter half of 2023 indicates a gradual recovery, driven by increasing institutional investments and broader acceptance of cryptocurrencies.

Factors Influencing Bitcoin Prices

- Global Economic Conditions: Economic uncertainty due to inflation rates and geopolitical tensions often drives investors toward Bitcoin as a store of value. Recent economic indicators suggest that these conditions remain volatile, influencing Bitcoin’s price movements.

- Market Participation: The entry of institutional investors has moved Bitcoin beyond being just a retail asset. Companies like MicroStrategy and Tesla have significantly influenced price surges through their purchasing strategies.

- Technological Enhancements: Lightning Network developments and upgrades in blockchain technology continue to foster Bitcoin’s utility, enticing more users and investors, thus affecting its price positively.

- Regulatory Environment: Cryptocurrency regulations remain a double-edged sword. Positive regulations may boost prices, while negative announcements can lead to sharp declines. Upcoming discussions in the U.S. Congress surrounding cryptocurrency policies could sway investor confidence and Bitcoin’s price.

Conclusion

Monitoring the Bitcoin price in USD is essential for understanding the broader financial landscape as cryptocurrencies become more integrated into traditional finance. Although the present outlook points towards a cautious recovery, investors should remain alert to significant market changes influenced by global economic conditions, regulatory developments, and technological advancements. As Bitcoin evolves, its price will continue to reflect not just market demand but also the shifting dynamics of the global economy.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.