Current Trends in Tesla Share Price: A Closer Look

Introduction

The Tesla share price has become a focal point for investors and market analysts alike, representing not just the company’s financial health but also broader market sentiments towards electric vehicles (EVs) and technology stocks. Recently, fluctuations in its stock price have drawn attention, raising questions about the future trajectory for one of the most valuable car manufacturers in the world. Understanding these movements is crucial for investors and stakeholders in the automotive and tech industries.

Recent Trends and Events

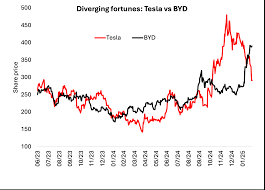

As of early October 2023, Tesla’s stock price has experienced considerable volatility. After peaking at approximately AUD 1,250 in early August, the share price has seen a significant downturn, currently trading around AUD 940. This drop can be attributed to various factors including market adjustments following strong quarterly earnings. Tesla reported a 25% increase in vehicle deliveries, exceeding market expectations, yet the stock saw declines amid concerns about rising production costs and intensifying competition in the EV sector.

Additionally, investor sentiment has been influenced by macroeconomic factors, including inflation concerns and interest rate hikes. Tech stocks, particularly those of companies like Tesla that have enjoyed rapid growth, are highly sensitive to changes in economic forecasts. Analysts are now closely monitoring Federal Reserve policies, as shifts could impact tech valuations and subsequently the Tesla share price.

Impact of Competition and Future Outlook

Moreover, Tesla faces increasing competition from both established automakers and new entrants into the EV space. Companies such as Ford, General Motors, and numerous startups are ramping up EV production, leading to a more crowded marketplace that could affect Tesla’s market share. Industry analysts predict that this could create a more volatile environment for Tesla’s stock as the company navigates its competitive landscape.

Future projections for Tesla’s share price remain mixed among analysts. Some contend that innovations such as advancements in battery technology and continued global expansion could bolster the stock price in the coming quarters. Others caution that heightened competition and economic pressures could result in further downward adjustments. Investment analysts recommend a cautious approach for those looking to enter the market, emphasizing the need for detailed analysis and consideration of Tesla’s long-term strategies.

Conclusion

The fluctuations in Tesla’s share price underscore the dynamic interplay of technological advancement, economic conditions, and competitive pressures within the automotive industry. For stakeholders, understanding these factors is essential for making informed investment decisions. As Tesla continues to innovate and adapt to market challenges, its path forward offers both opportunities and risks—a scenario that will undoubtedly continue to attract attention in financial markets.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.