Understanding Current Interest Rates in Australia

Introduction

Interest rates play a critical role in shaping the economic landscape of any country, and Australia is no exception. As of late 2023, the Reserve Bank of Australia (RBA) continues to make headlines with its monetary policy adjustments in response to economic conditions. Understanding these rates is essential for consumers, businesses, and investors alike, as they directly influence borrowing costs, savings returns, and overall economic growth.

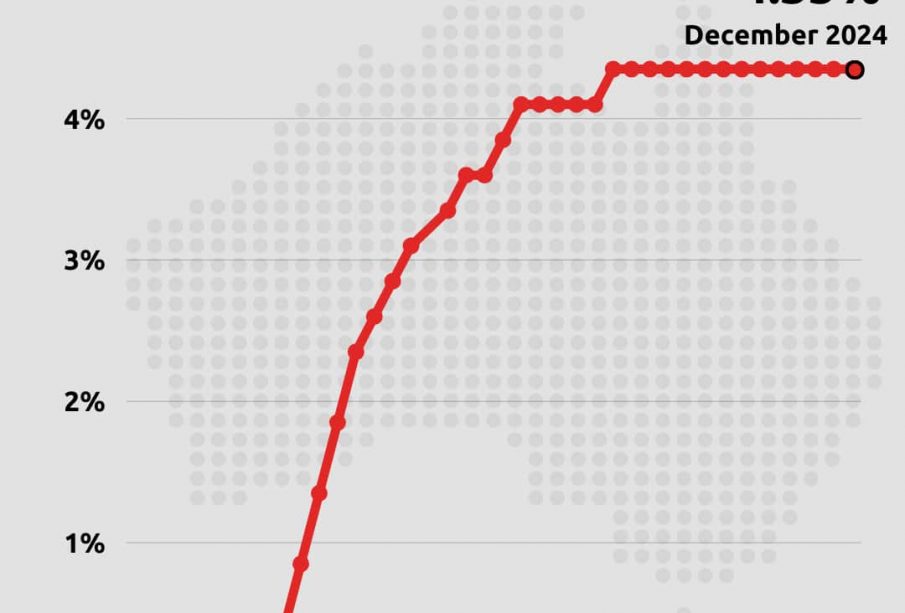

Current Interest Rates

As of October 2023, the RBA has set the cash rate at 4.10%, a level not seen in nearly two decades. This decision comes after a series of rate hikes aimed at curbing inflation, which has been persistently above the RBA’s target range. The latest figures show inflation in Australia at 5.5%, prompting the RBA to continue its strategy of tightening monetary policy to stabilize prices.

Impact on Borrowing and Spending

The increased interest rates have significant implications for both personal and business loans. Mortgage holders are feeling the pinch, with many facing higher monthly repayments which could lead to decreased spending in other areas. In fact, more than 40% of Australian households have reported tightening their belts due to rising costs associated with higher interest rates. Small businesses are also affected, as higher borrowing costs may delay investments and expansion plans.

Consumer Reactions and Adjustments

Consumers are increasingly aware of their financial situations. Reports indicate that many Australians are opting to switch to fixed-rate mortgages, securing lower rates to protect against potential future increases. Additionally, savings deposits are on the rise, as Australians seek to take advantage of higher interest rates offered by banks. Financial advisors recommend innovative budgeting strategies to adapt to the shift in economic conditions.

Conclusion

The current interest rates in Australia reflect the RBA’s ongoing battle against inflation and economic stability. Economists predict that while rates may stabilize in the coming months, they are likely to remain higher than the historical average until inflationary pressures ease significantly. This environment warrants close attention from both consumers and businesses, as the implications of these rates could continue to ripple through the economy. Understanding and adapting to these changes will be crucial for maintaining financial health in the evolving economic landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.