Understanding RBA Interest Rates in Australia: Current Trends

Introduction

The Reserve Bank of Australia (RBA) plays a crucial role in shaping the financial landscape of the nation through its monetary policy, particularly the management of interest rates. With inflation rates fluctuating and global economic conditions evolving, the RBA’s interest rate decisions are increasingly significant for households and businesses. As the Bank reviews economic indicators, understanding the implications of these decisions becomes essential for Australians.

Current Interest Rate Landscape

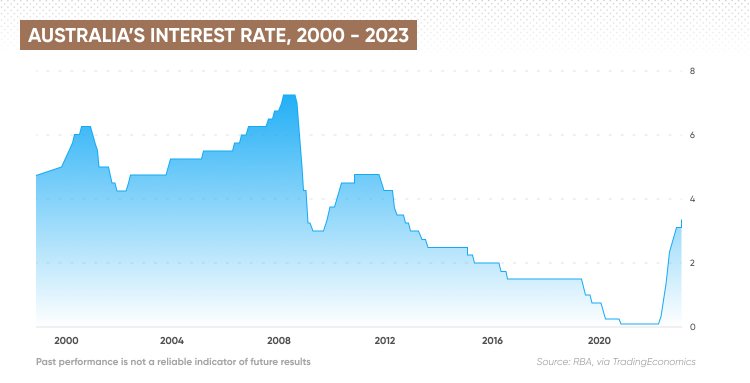

As of October 2023, the RBA has kept the cash rate at 4.10%. This decision follows a series of rate hikes throughout 2022 and early 2023, aimed at curbing inflation, which surged to a peak of 7.8% in December 2022. In recent months, inflation has shown signs of easing, falling to 5.3% by September 2023. However, this remains above the RBA’s target band of 2-3%, creating a complex environment for policymakers.

The RBA’s monetary policy meetings are essential for maintaining economic stability. Governor Philip Lowe highlighted that while the inflation outlook shows improvement, ongoing monitoring is essential to ensure inflation returns to target levels without undermining economic growth. He further indicated that while interest rate hikes have achieved desired effects, the Bank remains vigilant regarding external economic shocks.

Impact on Households and Businesses

The ongoing high interest rates have direct consequences for Australian households. With mortgage holders facing increased repayments, financial stress has become a pertinent issue for many families. According to recent surveys, around one-third of homeowners reported difficulty in meeting their mortgage obligations, raising concerns about a potential rise in defaults.

Additionally, businesses are feeling the pinch as borrowing costs rise. The higher cost of capital could suppress investment and slow down economic growth. Australian small businesses report concerns over maintaining operational budgets amid these pressures, which could lead to reduced hiring or expansion activities.

Conclusion: The Road Ahead

Looking forward, forecasts indicate that the RBA may continue to hold interest rates stable in the near term as they gauge the trajectory of inflation and economic recovery. Experts suggest that if inflation continues to decline, a possible rate cut could be on the horizon in mid-2024. However, these predictions depend heavily on both domestic and international economic influences.

For Australian consumers and businesses, staying informed about RBA interest rate decisions will be critical. These rates not only affect loans and mortgages but also play a significant role in shaping the broader economy, influencing everything from consumer spending to business investments. As such, keeping an eye on these developments will be vital in navigating the current economic landscape in Australia.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.