Understanding the Current Trends in AMD Stock Performance

Introduction to AMD Stock

Advanced Micro Devices, Inc. (AMD) is a leading semiconductor company known for its innovative technology in microprocessors, graphics solutions, and other advanced computing technologies. In recent years, AMD has gained significant market share, particularly against its long-time rival Intel, which has made AMD stock a focal point for investors and analysts alike. Understanding AMD’s stock performance is crucial in the context of the tech industry and for those who wish to either invest in technology stocks or diversify their portfolios.

Recent Performance Analysis

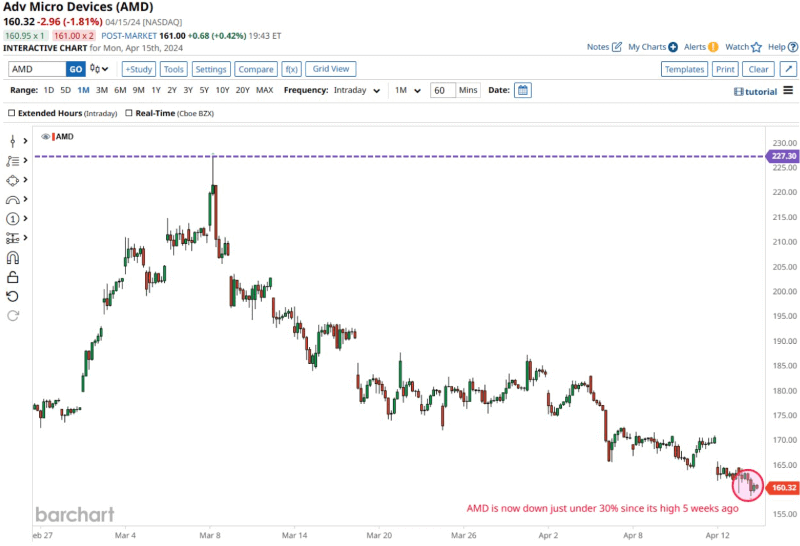

As of Mid-November 2023, AMD stock has seen substantial fluctuations. Following a strong recovery in the tech sector post-pandemic, AMD’s stock price reached its highest point in October 2023, peaking at around AUD 150 per share. However, recent quarterly earnings reports revealed a slight decline in revenue growth, primarily due to increased competition and supply chain challenges, resulting in a decline of approximately 10% in its stock value within the last month. Investors and analysts have closely monitored the scenario, trying to decipher whether this decline is a temporary setback or indicative of more significant issues.

Factors Influencing AMD Stock

Several key factors contribute to the fluctuations in AMD stock:

- Competition: The competitive landscape, especially with Intel’s latest product launches and the growing influence of Nvidia in the graphics processing unit (GPU) market, presents ongoing challenges for AMD.

- Innovative Products: AMD’s upcoming launches of its next-generation CPUs and GPUs are crucial. Expectations around technology advancements and product performance play a significant role in investor sentiment.

- Market Trends: General trends in the semiconductor industry, including demand for data centers, gaming, and artificial intelligence, significantly impact AMD’s revenue projections and stock performance.

Investor Sentiment and Future Forecasts

Market analysts are divided in their opinions regarding AMD’s future. Some suggest a rebound as AMD’s innovative technologies align with lighting trends in AI and cloud computing demands. Others express caution, noting the risks associated with ambitious projections against an unpredictable market landscape. Overall sentiment reflects a wait-and-see approach, with many investors closely following the upcoming product releases slated for early 2024.

Conclusion

For current and potential investors, AMD stock remains a topic of significant interest, given its evolving position in the semiconductor sector. Keeping an eye on competitive actions and market trends will be essential for making informed investment choices. Therefore, understanding the factors influencing AMD stock will aid readers in navigating their investment strategies in the tech industry.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.